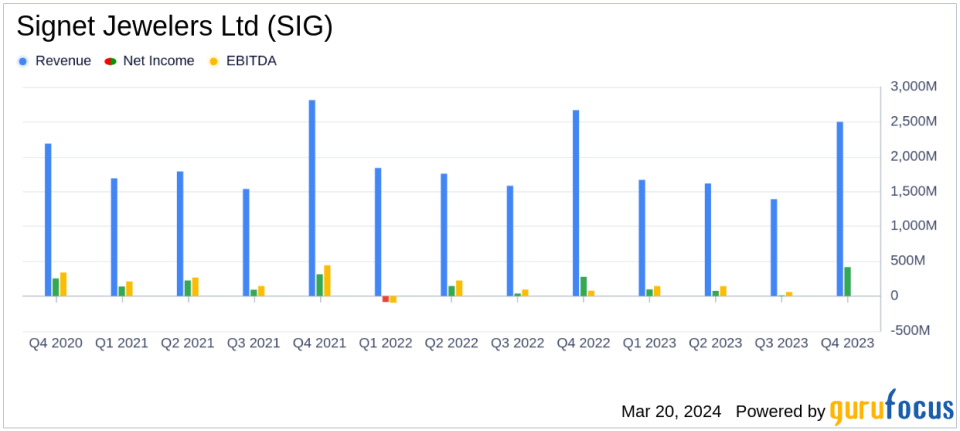

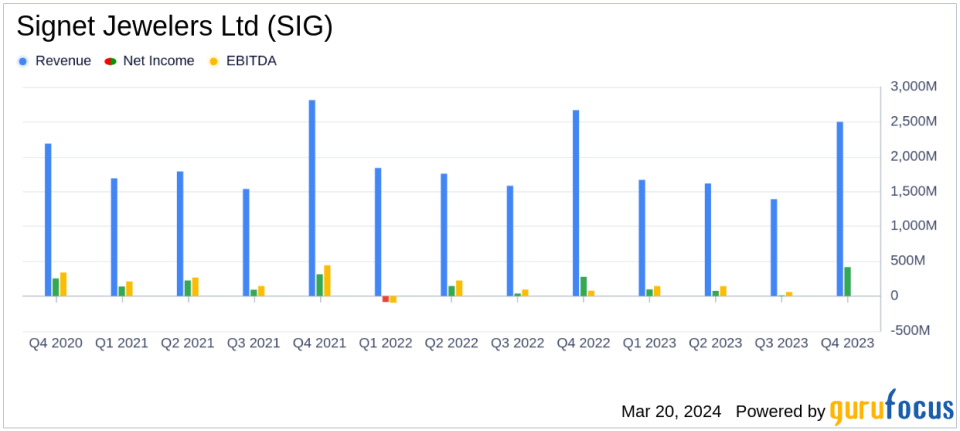

Total Sales: $7.2 billion in Fiscal 2024, a decrease of 8.6% year-over-year.

Same Store Sales: Down 11.6% compared to the previous fiscal year.

GAAP Operating Income: Increased to $621.5 million in Fiscal 2024 from $604.9 million in Fiscal 2023.

Non-GAAP Operating Income: Decrease to $642.8 million in Fiscal 2024 from $850.4 million in Fiscal 2023.

GAAP Diluted EPS: Rose significantly to $15.01 in Fiscal 2024, up from $6.64 in Fiscal 2023.

Non-GAAP Diluted EPS: Decreased to $10.37 in Fiscal 2024 from $11.80 in Fiscal 2023.

Dividend Increase and Share Repurchase: Raised common dividend by 26% and expanded share repurchase authorization to $850 million.

On March 20, 2024, Signet Jewelers Ltd (NYSE:SIG), the world’s largest retailer of diamond jewelry, released its 8-K filing, announcing its fourth quarter and full fiscal year 2024 results. The company, known for its extensive portfolio of jewelry stores including Kay Jewelers, Zales, and Jared, navigated a challenging year with a strategic focus on brand equity, customer experience innovation, and product newness.

Fiscal Year 2024 Performance Overview

For the 53 weeks ended February 3, 2024, Signet reported total sales of $7.2 billion, a decrease of 8.6% compared to the previous year. The company faced headwinds with same store sales declining by 11.6%. Despite these challenges, Signet achieved a GAAP operating income of $621.5 million, up from $604.9 million in the previous year, and a significant increase in GAAP diluted EPS to $15.01, compared to $6.64 in Fiscal 2023. This EPS growth includes a substantial benefit from a deferred tax assets related to new tax legislation in Bermuda.

Non-GAAP operating income for Fiscal 2024 was $642.8 million, a decrease from $850.4 million in Fiscal 2023. Non-GAAP diluted EPS also saw a decrease to $10.37 from $11.80 in the prior year. The company attributes the decline in non-GAAP measures to various factors, including lower full-year income and legal settlements, partially offset by improvements in working capital.

Strategic Initiatives and Financial Discipline

Signet’s CEO Virginia C. Drosos emphasized the company’s resilience and the effectiveness of its flexible operating model, which generated over $600 million in free cash flow for the fourth consecutive year. The company’s disciplined cost management and agile inventory practices have been pivotal in this achievement. Signet also announced a $350 million cost savings initiative over the next three years to further bolster its financial position.

Joan Hilson, Chief Financial, Strategy & Services Officer, highlighted the company’s robust cash conversion, leading to an increase in share buyback authorization and a raised dividend. Signet’s Board of Directors declared a quarterly cash dividend on common shares of $0.29 per share for the first quarter of Fiscal 2025, marking a 26% increase from the previous year.

Looking Ahead: Fiscal 2025 Guidance

For Fiscal 2025, Signet anticipates a sequential improvement in same-store sales as engagements are expected to gradually recover. The company plans to invest in marketing personalization, product innovation, and service business expansion. Signet forecasts sales between $1.47 to $1.53 billion for the first quarter of Fiscal 2025, with same store sales ranging from a decline of 11% to 7%. Operating income is projected to be between $40 to $60 million, with adjusted EBITDA estimated at $87 to $107 million.

Signet’s outlook for Fiscal 2025 reflects strategic investments, a three-year engagement recovery, and continued cost savings initiatives. The company’s capital expenditure plans include new store openings, nearly 300 renovations, and advancements in digital and technology capabilities.

Value investors may find Signet’s commitment to cost management, strategic investments, and capital returns to shareholders appealing, as the company navigates through industry challenges and positions itself for sustainable growth.

For a detailed analysis of Signet Jewelers Ltd (NYSE:SIG)’s financials and strategic outlook, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Signet Jewelers Ltd for further details.

This article first appeared on GuruFocus.